Clayton M. Christensen and Tara Donovan

When described with the historical perspective of logically written business school case studies, companies’ strategies often seem to be the product of an organized and rigorous planning process. The way that most companies’ strategies actually come to be defined, however, is often quite different. Organizations whose strategies have propelled them to the tops of their industries not infrequently arrived at those strategies through trial, error and unanticipated success. Rarely was the winning strategy clear to the combatants at the outset. As organizations dive deeper into the undefined waters of the new economy and as traditional business models are being turned inside out, it is crucial that leaders of established and start-up companies alike understand the processes by which strategies are shaped, in order to guide their companies effectively. The purpose of this paper is to describe a simple model of the processes by which strategy comes to be defined and is implemented. Understanding the key dimensions of this process can help executives keep their hands more precisely on those levers that control how strategy gets defined and implemented, and to adjust the workings of that process as the competitive environment changes.

Two Processes of Strategy Formulation

In every company there are two independent and simultaneous processes through which strategy comes to be defined. The first strategy-making process is conscious and analytical, involving assessments of market structure, competitive strengths and weaknesses, the nature of customer needs, and the drivers of market growth. Strategy in this process typically is formulated in a project with a discrete beginning and end. Top-tier management consultants often manage these projects. The result of this process is an intended or deliberate strategy. [1 ] Intended strategies can be implemented as they have been envisioned if three conditions are met. First, those in the organization must understand each important detail in management’s intended strategy. Second, if the organization is to take collective action, the strategy needs to make as much sense to each of the members in the organization as they view the world from their own context, as it does to top management. Finally, the collective intentions must be realized with little unanticipated influence from outside political, technological or market forces. Since it is difficult to find a situation where all three of these conditions apply, it is rare that an intended strategy can be implemented without significant alteration. [2]

The second strategy-making process has been termed emergent strategy. It is the cumulative effect of day-to-day prioritization decisions made by middle managers, engineers, salespeople and financial staff – decisions that are made “despite, or in the absence of, intentions.”[3 ] In fact, managers typically do not frame these decisions as strategic at all, at the time they are being made; they have a decidedly tactical character. For example, Intel’s decision to accept an order from Busicom, a second-tier Japanese calculator company, started the company on the path to microprocessors. Sam Walton’s decision to build his second store in another small town near his first one in Bentonville, Arkansas rather than in a large city, led to Wal-Mart‘s discovery of the attractive economics of building pre-emptively large stores in small towns. Emergent strategies result from managers’ daily response to problems or opportunities that were unforeseen by those engaged in the deliberate strategy-making process, at the time they were doing their analysis and planning.

The Resource Allocation Filter

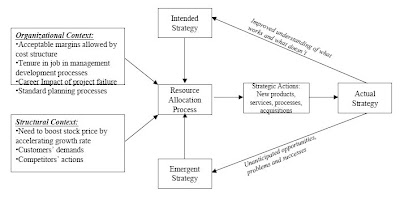

Factors that affect and ultimately comprise a company’s strategy stream continuously from these intended and emergent sources. Regardless of the source, however, they then must flow through a common filter – the resource allocation process. This is because a company’s actual strategy is manifest only through the stream of new products, processes, services and acquisitions to which resources are allocated. The resource allocation process acts like a filter that determines which intended and/or emergent initiatives get funding and pass through, and which proposals are denied resources.

The resource allocation process is a complex, diffused process that occurs at every level, every day, in all companies. For example, a saleswoman must decide which customer to call on today, and which customer she will not visit. When meeting with the customer, she must decide which products to emphasize in the conversation, and which to ignore. Every day that an engineer who is a member of multiple product development teams comes to work, he or she needs to decide which of those projects to work on that day, and which to put on the back burner. Senior managers regularly decide which projects or capital investments to fund, and which ones to kill. Each of these types of decisions, occurring at all levels of the organization every day, comprise its resource allocation process.

If the criteria that guide prioritization decisions in this diffused resource allocation process are not carefully tied to the company’s intended strategy (and often they are not), significant disparities can develop between a company’s intended strategy and its actual strategy. Understanding and controlling the criteria by which day-to-day resource allocation decisions are made at all levels of the organization, therefore, is a key challenge in managing the process of defining and implementing strategy.

Initiatives that receive funding and other resources from the resource allocation process can be called strategic actions, as opposed to strategic intentions. Intel chairman Andy Grove has said, “In my experience, [top-down strategic plans] always turn into sterile statements, rarely gaining traction in the real work of the corporation. Strategic actions, on the other hand, always have real impact.”[4] In other words, Grove counsels, “To understand companies’ actual strategies, pay attention to what they do, rather than what they say.” In our parlance, this means that a company’s strategy is defined by what comes out of the resource allocation process, not by what goes into it.

Figure 1 charts the confluence of these strategy-making processes. Strategic ideas and initiatives, whether of intended or emergent origin, are filtered through the resource allocation process. What emerges are strategic actions – the flow of new products, services, processes and acquisitions that define what the company actually does. As the company does these things, managers then confront and respond to unexpected crises and opportunities which cycle back into the emergent process. And as managers learn what works and what doesn’t in the competitive marketplace, their improved understanding flows back into the intended strategy process. Each resource allocation decision, no matter how slight, shapes what the company actually does. This creates a new set of opportunities and problems, and generates new intended and emergent inputs into the process.

Several well-known case studies illustrate how these processes of strategy-making work. For example, during the post-War era, Honda Corporation was a supplier of small, rugged “Supercub” motorcycles designed to maneuver through the Japan’s congested cities.[5 ] Supercub sales had grown to 300,000 units by 1959, and management, eager to take advantage of Japan’s low labor costs, targeted the North American market for growth. Research showed that Americans used motorcycles for long over-the-road excursions, rather than the short urban trips for which the Supercub was designed – so Honda’s engineers designed and manufactured a larger over-the-road bike for the American market. Honda management reasoned that their labor cost advantage was sufficient to secure at least 10% of the American market in competition against the likes of Harley Davidson and Triumph, and they sent three employees to Los Angeles to launch the effort.

Honda’s team ran into a series of setbacks in America, however. Most motorcycle dealers were unwilling to accept an untested product line. When the team finally signed up several dealers who then sold a few hundred units, Honda’s inexperience in design for vehicles in highway use became apparent as clutch problems and oil leaks severely damaged the engines. Repairs on warrantied bikes nearly bankrupted the company.

To minimize start-up costs and live within foreign exchange restrictions that had been imposed by the Japanese government, the members of the Honda team had brought Supercub bikes with them to use for personal transportation in Los Angeles. One Saturday after a particularly frustrating week, one member of the team decided release his frustrations by racing his Supercub through the hills east of Los Angeles. It was fun. He invited his two colleagues to join him, and “dirtbiking” became a regular recreational outlet. As others saw this new sport and thought it looked fun, they began requesting that the Honda managers special-order Supercubs for them so that they could join in the fun. Within a year or so, the buyer for the power equipment section of the Sears, Roebuck catalog learned of this new sport, and asked if he might offer the Honda dirtbike for sale through his catalog. Because selling Supercubs was not the company’s strategy, however, the team declined the opportunity and continued their focus on trying to make the large, over-the-road bike strategy work.

After nearly three years, the unanticipated popularity of the Supercub and unanticipated difficulty with large bikes convinced the Honda America team that they had happened upon a better strategy – selling small bikes as recreational vehicles. They then commenced a protracted effort to persuade corporate management to support the change.

The Honda team subsequently found that traditional motorcycle dealers were even more reluctant to sell dirtbikes than Honda’s larger bikes, because the low price point and profit margins on the Supercub were unattractive. With few alternatives, the Honda team finally persuaded a few sporting goods retailers – who found dirtbikes to be quite profitable relative to the other products in their merchandise mix – to carry the product line, and the popularity of dirtbikes began to soar. A UCLA advertising student in a term paper came up with what became Honda’s award-winning advertising slogan, “You meet the nicest people on a Honda.” These ads featured grandmothers, teen-agers and businesspeople on Honda bikes – quite different customers than traditional motorcycle clientele.

By 1964 most elements of a winning strategy had emerged for Honda, quite by trial and error. With this understanding of what worked and what didn’t, Honda then aggressively scaled the business. As production volumes increased, Honda followed a classic experience-curve strategy by cutting prices to build volume, which further reduced costs and enabled additional price reductions. Honda’s product designers systematically increased the size and power of Honda’s products, disruptively moving up-market.[6] Traditional cycle competitors found that they could not compete with Honda in the lower tiers of the market, and retreated into the high end by emphasizing sales of larger bikes, until ultimately only Harley Davidson and BMW survived as niche players. By the 1980s, Honda had become the dominant motorcycle brand in America.

In terms of the model diagrammed in Figure 1, Honda began its efforts with an intended strategy. Almost immediately, emergent inputs such as the reluctance of traditional dealers to carry Honda’s bikes and the Sears buyer’s request were received, but Honda’s resource allocation process filtered out those inputs to its strategy. Finally, the accumulated evidence convinced the Honda team that a better strategy was at hand. They persuaded corporate management to change the filter in the resource allocation process – and one by one, the elements of a winning strategy emerged. Once the rules of this game became clear, Honda switched the filter in the resource allocation process again, and a remarkably successful intended strategy process was executed.

The Crucial Role of Resource Allocation in the Strategy Development Process

Professors Joseph L. Bower [7] of the Harvard Business School and Robert Burgelman [8] of Stanford have documented how resources get allocated across competing alternative investments at all levels of the organization. They note that the vast majority of ideas for developing new products, services and processes “bubble up” from employees within the organization. Middle managers cannot carry all of these ideas up to senior management for approval and funding, however, and must decide which of the ideas bubbling up to them they will throw their weight behind, and which they will allow to languish. Middle managers’ decisions therefore play a crucial role in the resource allocation process. If senior managers want to control the process by which strategy is defined and implemented, they must understand and shape the criteria that middle managers and those below them are using to make prioritization decisions.

As Figure 2 suggests, the criteria that constitute the filtering mechanisms in the resource allocation process comprise two categories – the organizational context and the structural context. The following paragraphs discuss examples of the factors that comprise these dimensions of context.

Organizational Context

Although organizational context has many dimensions, three of them are particularly powerful filtering mechanisms in almost every organization’s resource allocation process. The first is the structure of the company’s income statement. This determines the gross profit margins that the company must earn to cover overhead costs and earn a profit. Most managers have a very difficult time according priority in the resource allocation process to innovative proposals that will not maintain or improve the organization’s profit margins. The effect that such a filtering mechanism can have on a company’s strategy possibilities can be profound. 3M Corporation, for example, is one of the most innovative companies in modern history, in terms of its abilities to apply its core technological platforms to an array of market applications. It’s insistence that all new products meet relatively high gross margin targets, however, has focused the company into a vast array of small, premium product niches, and has prevented all but a few of its new products from becoming large mass-market businesses.

A second important element of organizational context is the short tenure in a given job that is typical in the career path of high-potential employees. Management development systems in most organizations move high-potential employees into new positions of responsibility every two years or so, in order to help them master management skills in various parts of the business. The effect of this practice, however, is to limit the payback time on investment proposals that most managers can enthusiastically endorse. Aspiring managers will instinctively accord priority to efforts that will pay off within the typical tenure in their jobs, in order to produce the improved results required to earn attractive promotions. The short-sighted investment horizons of results-oriented managers, which typically are attributed to Wall Street’s demands for near-term profit improvement, are in fact deeply embedded in the management development processes of most good companies.

Figure 2: Contextual Factors that Affect the Filtering Mechanisms in the Resource Allocation Process

Structural Context

Structural factors in a company’s environment also affect the filtering criteria that managers employ in the resource allocation process. For example, good managers always feel pressure to maintain or accelerate their companies’ growth rate because their stock price is predicated upon growth. This means that as a company grows, it must bring in larger and larger pieces of new business each year. Hence, as a company becomes larger the size threshold that new product or service opportunities must meet in order to get through the resource allocation filter grows. Opportunities which at one point were energizing in a smaller company’s resource allocation process get filtered out as “not big enough to be interesting” in a larger company.

Competitors’ actions likewise powerfully influence what managers must push through the resource allocation filter. If a competitor threatens to steal customers or growth opportunities away from a company, managers have almost no choice but to respond.

Because the factors in the organizational and structural context often exert such a powerful directive influence on the investments that can emerge from its resource allocation process, in some instances actual strategy can be shaped far more powerfully by these forces than by the intentions of senior managers themselves – as the following case study illustrates.

ntel began as a manufacturer of semiconductor memories, and its founding engineers developed the world’s first commercially viable dynamic random access memory (DRAM) chips. [9] In 1971 an Intel engineer serendipitously invented the microprocessor during a funded development project for a Japanese calculator company. Although DRAMs continued to account for the lion’s share of company sales through the 1970s, Intel’s sales of microprocessors grew gradually in a host of small, emerging applications.

Intel allocated a key resource, wafer fabrication capacity, according to the gross margin per wafer that was earned in each of its product lines. Once each month Intel’s production schedulers met to allocate the available production capacity across their products, which ranged from DRAMs to EPROMs to microprocessors. The sales department would supply to the group its forecast shipments, and accounting would provide a rank ordering of those products earning the highest margins per wafer, down to those earning the lowest. The highest-margin product would then be allocated all of the production capacity needed to meet its shipments forecast. The next-highest margin product would then get all the capacity it needed in order to meet forecast shipments, and so on – until the product line with the lowest gross margins was allocated whatever residual capacity remained.

In the early 1980s the Japanese DRAM makers intensified their attack on the US market, causing pricing levels to drop precipitously. Hence, the gross margins Intel could earn on its DRAM products relegated DRAMs to the lowest ranks of the list every month. There was less intense competition in microprocessors. Microprocessors consistently had the most attractive gross margins in Intel’s product portfolio, and the resource allocation process therefore systematically diverted manufacturing capacity away from DRAMs and into microprocessors. This occurred without any explicit management decision to change strategy. Senior management, in fact, continued to invest two-thirds of R&D dollars into the DRAM business even as the resource allocation process was executing a systematic exit from DRAMs.

They believed that DRAMs were the “technology driver,” and that remaining competitive in DRAMs was essential in order to be competitive in other product lines. Finally, by 1984, when the company had plunged into financial crisis and DRAMs had contracted to only 3% of Intel’s volume, senior management recognized that Intel had become a microprocessor company. They stopped DRAM R&D spending, and Gordon Moore and Andy Grove made their storied exit through the company’s revolving lobby door as managers of the old company, and re-entered as managers of the new company. [10] But it was the resource allocation process that transformed Intel from a DRAM company into a microprocessor company. Intel’s remarkable strategy shift was not the result of an intended strategy articulated within the executive ranks, but rather it emerged through the daily decisions made by middle managers as they allocated resources. Once this new business opportunity had become clear, then, of course, Intel’s management could masterfully implement a deliberate strategy.

In fact, Burgelman notes that given the power that emergent forces have in the strategy-making process, one of the most important roles of senior management is to recognize what has happened – to learn from emergent sources what works, and then to cycle that learning back into the process through the deliberate channel.

Seen in the light of this model, the simplistic sequence in the minds of many students and consultants that strategies are first formulated and then implemented, can rarely be the case. Strategy is never static. All companies must at the outset chart their course in an intended direction, of course; but the evidence is quite strong that the right strategy can rarely be known at the outset. In early stage industries, strategy development needs to be dominated by emergent forces. For example, in a recent survey of 400 entrepreneurs (200 of whom had built successful companies and 200 of whom had failed), Bhide [11] asked those who had succeeded to indicate whether the strategy that had led to their success was the strategy that they originally had set out to implement. Ninety-three percent responded that the strategy that led to their success was substantially different than their initial intentions. The difference between those that succeeded and those that failed was not that the successful entrepreneurs got it right the first time. The successful ones simply had money left over to try again, after they learned that their initial strategy was flawed.

As Mintzberg and Waters advise, “Openness to emergent strategy enables management to act before everything is fully understood—to respond to an evolving reality rather than having to focus on a stable fantasy…. Emergent strategy itself implies learning what works—taking one action at a time in a search for that viable pattern or consistency.”[12]

There comes a time in successful companies’ start-up histories, of course, when the viable pattern has emerged. At this point, with a firm hand on the criteria used as filters in the resource allocation process, managers need to reverse the flow of strategy-making toward the intended direction. Rather than continuing to feel their way into the marketplace, they need to boldly execute the strategy that they have learned will work. Honda, Intel, Wal-Mart, and a host of other companies each saw a viable strategy emerge that was substantially different than what their founders had been able to envision. But they then executed that strategy aggressively, once the model was clear.

Process Ambidexterity: A Tricky Skill that Few Managers Have Mastered

Ultimately, as our research into disruptive technologies points out, the filters in the resource allocation process of successful companies can become so well-shaped to the successful strategy that the resource allocation process simply filters out any initiatives – whether of intended or emergent origin – that do not sustain the company’s historically successful strategy. This renders companies incapable of starting new growth businesses, and in particular, causes them to ignore the disruptive technologies that ultimately improve and grow to overthrow the prior industry leaders. Proposals that would have led DEC decisively into personal computers; Xerox into tabletop photocopiers; USX into steel minimills; and F.W. Woolworth into discount retailing emerged repeatedly in these companies, but were all starved of adequate funding in their respective resource allocation processes.

Managing the strategy development process requires rare skill by senior managers when disruptive threats and opportunities emerge. In the first place, enough resources need to be allocated to disruptive innovations to enable the company to catch and lead the industry in the disruptive wave that is threatening the leaders, while still investing sufficiently in sustaining innovations to keep the mainstream business competitive and profitable. In the second place, it requires that the corporation’s stable, established businesses be driven by intended strategy, even while the new, disruptive emerging businesses are practicing emergent strategy development.

In our studies we have found a few companies whose executives have proven capable of allocating resources sensibly across sustaining and disruptive businesses. But very, very rarely have we seen executives who have consistently demonstrated the ability to manage the strategy development process appropriately across a range of businesses in various stages of maturity. For example, Prodigy Communications, a joint venture between Sears and IBM, was a pioneer in online services in the early 1990s. The managers of Sears and IBM were extraordinarily bold in resource allocation – they invested over a billion dollars in what was a very uncertain, disruptive innovation. But the managers weren’t as successful in managing the strategy process – in helping Prodigy define a viable strategy through emergent channels, even while the parent companies were managing their mainstream businesses deliberately. With the deliberate model in its managers’ minds, Prodigy’s business plan envisioned that consumers would use on-line services primarily to access information and make on-line purchases.

In 1992, Prodigy realized that its two million subscribers were spending more time sending e-mail than downloading information or making purchases on line. The architecture of Prodigy’s computer and communications infrastructure had been designed to optimize transactions processing and the delivery of information, and Prodigy consequently began charging extra fees to subscribers who sent more than 30 e-mail messages per month. Rather than see the emergence of e-mail as an emergent strategy signal, the company tried to filter it out, because it was inconsistent with the intended strategy.

America OnLine (AOL) luckily entered the market later, after customers had discovered that e-mail was a primary reason for subscribing to an on-line service. With a technology infrastructure tailored to messaging and its ”You’ve got mail” signature, AOL became much more successful.

In light of our model, Prodigy’s mistake was not that it entered the market early. Nor was it a mistake that management targeted on-line information retrieval and shopping as the primary attraction of an on-line service. Nobody could know how on-line services would be used. Rather, the mistake was that the company employed a deliberate strategy process before the correct strategy could be known. Had Prodigy kept strategic and technological flexibility to respond to emergent strategic evidence, the company could have had a huge lead over AOL and Compuserve, given the network-effect advantages that come from having the largest number of subscribers.

A similar challenge confronted the set of companies in the early 1990s that responded to the widely held view that a large market for hand-held personal digital assistants (PDAs) was about to emerge. Many of the leading computer makers – including NCR, Apple, Motorola, IBM and Hewlett Packard – targeted this market, along with a few start-up firms like Palm Computing. All of these firms sensed that the market wanted a hand-held computing device. The technological challenges included incorporating in adequate storage, getting long-enough battery life, and handling input for these devices, which were too small to incorporate keyboards. Apple was the most aggressive of the innovators in this space. Its Newton cost $350 million to develop, because of the technologies such as handwriting recognition technology that were required to build as much functionality into the product as possible. Hewlett Packard also invested aggressively to design and build its tiny Kittyhawk disk drive for this market.

In the end, the products just weren’t good enough to be a substitute for notebook computers. Because their products were too expensive to be used for simpler applications, and each of the companies scrapped its effort – except Palm. Palm’s original strategy was to provide an operating system for these personal digital assistants. When its intended customers’ strategies failed, Palm searched around for another application – and came upon the concept of an electronic personal organizer. The rest is history. From its simple beginnings, the Palm Pilot has moved disruptively up-market. As mobile communications technology gets combined with the Palm Pilot, it now is beginning to look like a menacing disruptor to the notebook computer – though the strategy for getting there has turned out to be entirely different than anyone imagined at the outset.

What were the mistakes here? Concluding that the computer companies’ mistake was to conceive of the product as a hand-held computer is simplistic. That is akin to asserting that in order to be right, one should not be wrong. Their original strategy was as close to the right idea as anyone could come at the outset. The mistake was that the computer companies employed intended strategy processes from the beginning to the end. They invested massively to implement their strategies, and then wrote the projects off when the strategies proved wrong. Of them all, only Palm shifted to an emergent strategy process when its original intended strategy failed. When a viable strategy emerged, Palm shifted back towards a deliberate process as it migrated up-market.[13]

Clearly, this is not simple stuff. Many processes in an organization can become so refined and effective that they simply keep chugging along with little top-management attention, freeing managers to worry about more non-standard dimensions of the business. It is clearly dangerous, however, to allow the strategy development process ever to operate on auto-pilot. At any given point in time, some businesses under a manager’s care may need to be managed through aggressive, intended strategy processes, while others need to be managed through emergent processes. Nearly all companies, however, employ one-size-fits-all systems.

Similarly, within a single successful business over time, there is great danger that the resource allocation process will become so closely tuned to the company’s intended strategy that emergent inputs that should influence the company’s strategy get filtered out. This is why successful companies historically have almost always failed to catch disruptive technologies, and why most established companies aren’t successful at creating new markets for new technologies. Managing the filters in the resource allocation process in a way that is appropriate to time and place is a skill that few managers ever have demonstrated consistently.

In their research and teaching, many strategy scholars focus on the content of strategy, with an eye to helping students and managers understand what good strategy is; what competitive advantage is; and so on. These are crucial issues. We hope, however, that this simple way of framing of the process by which strategy comes to be defined might make the task of managing the development and evolution of strategy across a variety of businesses in the rapidly changing world more tractable.

_______________________________

[1] The notion that these two different processes coexist was first articulated by Henry Mintzberg and James Waters in their classic paper, “Of Strategies, Deliberate and Emergent,” Strategic Management Journal (6), 1985, p. 257.

[2] Ibid., p. 258

[3] Ibid., p. 257.

[4] Grove, Andrew. Only the Paranoid Survive. (Doubleday: New York, 1996), p. 146.

[5] This histories are described in a pair of classic Harvard Business School case studies, Honda (A) and Honda (B) by Professor E. Tatum Christensen.

[6] Christensen, Clayton M., The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. Boston: Harvard Business School Press, 1997.

[7] Bower, Joseph L. Managing the Resource Allocation Process. (Harvard Business School Press: Boston, 1986)

[8] Burgelman, Robert A. and Leonard Sayles. Inside Corporate Innovation, (The Free Press: New York, 1986)

[9] Burgelman, Robert A., “Fading Memories … ,” Organization Science, 1991, pp.

[10] Grove, Andy, op,cit., pp.

[11] Bhide, Amar, “ ,“ Harvard Business Review.

[12] Mintzberg and Waters, “Of Strategies,” p. 271

[13] As of this writing (early 2000), it seems clear that Palm Computing badly needs to reverse its dominant strategy process again, as the modular concept being promulgated by Handspring seems to be gaining traction in the market. Handspring’s concept is to market a Palm Pilot-like core device with multiple plug-in modules that enable it to be used as a mobile phone, digital camera, etc. Palm needs to let more emergent inputs through its resource allocation process in order to respond effectively to these developments.